Reading Time: < 1 minute MarketsFarm — The ICE Futures canola market was in freefall mode through the first half of March, hitting its weakest levels in over a year. While the losses may be looking overdone, the bottom remains to be seen. “This has been a brutal drop in canola,” said Bruce Burnett, director of markets and weather with […] Read more

ICE weekly outlook: No floor in sight for overdone canola

'A lot of money playing around in canola right now'

Canola crush of 2022 smallest in five years

Meanwhile, soybean crush rose on the year

Reading Time: 2 minutes MarketsFarm — Statistics Canada (StatCan) reported that 2022 had the smallest domestic canola crush for a calendar year since 2017. As well, 2022 marked the smallest canola oil production in five years and the least amount of canola meal produced in four years. The sharp reduction of canola being crushed was due to the 2021 […] Read more

Confirmation of large canola short position slowly appears

CFTC data flow slowly resuming

Reading Time: < 1 minute MarketsFarm — The size of the fund short position in canola rose in February and likely grew even larger in March, as weekly Commitments of Traders data slowly trickles out from the U.S. Commodity Futures Trading Commission (CFTC). CFTC data has stalled since a ‘cyber-related incident’ delayed the release of the data for weeks. As […] Read more

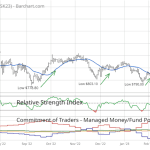

Reading between the lines: Oversold canola due for correction

Technical signs point to possible recovery

Reading Time: 2 minutes MarketsFarm — Canola futures posted sharp losses over the past week, with the May contract touching its weakest level in six months. While damage was done from a chart standpoint, there are technical signs that a recovery is possible. RSI The relative strength index (RSI) is a technical indicator that provides insight into whether a […] Read more

Canola industry ready to move forward

Reading Time: < 1 minute The Canola Council of Canada celebrated a return to normalcy at its annual meeting at the Canadian Crops Convention in Ottawa. “Our theme this year is ‘from adversity to opportunity’ and I think that’s very fitting,” said Jim Everson, the group’s president. Production has rebounded following the drought of 2021, meaning there’s opportunity to develop […] Read more

USDA sees increased EU canola imports, no extra from Canada

U.S. also projects higher Canadian ending stocks

Reading Time: < 1 minute MarketsFarm — The European Union will likely import more canola (rapeseed) this year than earlier thought, but any increased movement should come from Australia or Ukraine rather than Canada, according to updated projections from the U.S. Department of Agriculture. USDA raised its forecast for European rapeseed imports during the 2022-23 marketing year by 550,000 tonnes, […] Read more

ICE weekly outlook: Upswings likely out of question for canola

Canada's exports expected to ebb

Reading Time: 2 minutes MarketsFarm — Don’t expect any large increases in canola prices any time soon, according to Ken Ball of PI Financial in Winnipeg. In fact, there’s a good chance seen that old-crop canola could fall below its support level of $800 per tonne. Ball said 2022-23 canola ending stocks in Canada could increase because of the […] Read more

Record winter crop production expected for Australia

Summer crop production seen down on year

Reading Time: 2 minutes MarketsFarm — Australia will see its highest-ever winter crop production thanks to record wheat and canola harvests, according to the latest crop report from the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) released Monday. Winter crop production in Australia is estimated at 67.6 million tonnes, up 8.4 per cent from ABARES’ crop […] Read more

Merit Foods stakeholder looking to buy company

Burcon 'actively engaged' with company's receiver

Reading Time: 2 minutes One of the joint-venture owners of Winnipeg pea and canola protein processor Merit Functional Foods says it’s in talks to buy full control of the cash-strapped company. Two days after Merit entered a court-ordered receivership, Vancouver-based Burcon NutraScience announced Friday it “intends to submit a formal proposal to acquire the business.” Burcon said Merit’s receivership […] Read more

Plant protein processor Merit Foods in receivership

Company owes $95 million to EDC, FCC

Reading Time: 3 minutes The company behind a new Prairie processing plant extracting plant-based proteins from peas and canola has landed in receivership, in the high eight figures’ debt to its secured lenders. PricewaterhouseCoopers (PwC) on Wednesday announced it’s the receiver for both Merit Functional Foods Corp. and the numbered company that owns Merit’s processing plant and property in […] Read more