Glacier FarmMedia — The ICE Futures canola market settled narrowly mixed on Tuesday after trading to both sides of unchanged in choppy activity.

- Gains in Chicago soyoil and soybeans provided spillover support, with solid monthly crush data behind some of the strength in that market.

- However, European rapeseed was lower on the day, while many Asian markets were closed for the Lunar New Year holiday.

- The May contract ran into upside resistance, briefly trading above the psychological C$680 per tonne level before backing away to end roughly five dollars off its session highs.

- Large South American soybean supplies continued to temper any gains in the North American oilseed futures amid the advancing Brazilian harvest.

- There were 87,301 contracts traded on Tuesday, which compares with Friday when 82,956 contracts changed hands. Spreading was a feature, accounting for 69,806 of the contracts traded.

Read Also

ICE review: Canola hits six-month highs

Glacier FarmMedia — The ICE Futures canola market climbed to its highest levels in six months on Wednesday, as…

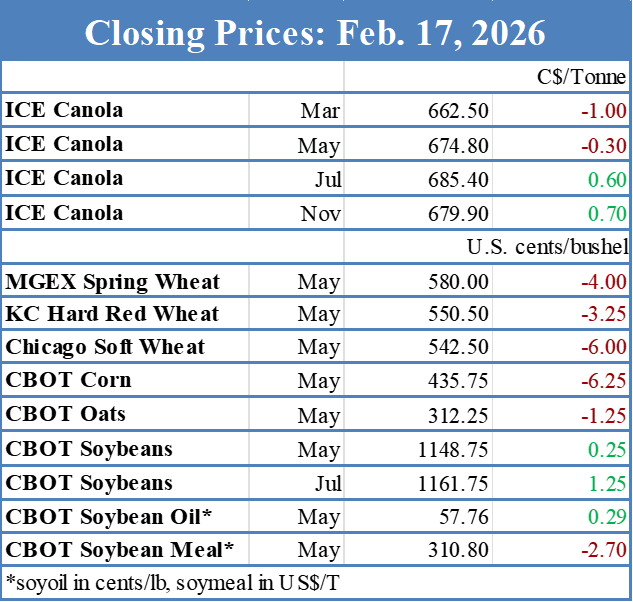

Access the latest futures prices at https://www.producer.com/markets-futures-prices/

Stay informed with our daily market videos. Each video quickly covers key futures moves, price trends and market signals that matter to Canadian farmers. Get clear, timely insights in just a few minutes. Bookmark https://www.producer.com/markets-futures-prices/videos