Glacier FarmMedia | MarketsFarm — Canola futures on the Intercontinental Exchange rebounded from recent losses in the middle of Wednesday trading, gaining strength from vegetable oils. The November contract was slightly below its 20- and 50-day averages.

Chicago soyoil, European rapeseed and Malaysian palm oil made gains today. However, crude oil showed declines as the trade focused on trade negotiations between the United States and other countries.

An analyst said Chicago soyoil’s rise, which supports canola prices, could be attributed to U.S. President Donald Trump’s announcement of a new trade deal with Japan.

Read Also

ICE canola lower despite rising crude oil

Glacier FarmMedia – Canola futures on the Intercontinental Exchange remained in negative territory on Wednesday morning as nearby prices stay…

Much of Alberta as well as southern Saskatchewan and southern Manitoba will see more scattered showers today. However, the latter two locations will be sunny in the coming days. The analyst said canola has stabilized in those areas that received rain.

The Canadian dollar was up less than one-tenth of a U.S. cent compared to Tuesday’s close.

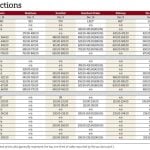

About 24,500 canola contracts have traded at 10:20 CDT. Prices in Canadian dollars per metric tonne:

Price Change

Nov 697.20 up 7.20

Jan 707.10 up 6.90

Mar 713.90 up 7.30

May 715.50 up 4.00

To access the latest futures prices, go to https://www.producer.com/markets-futures-prices/