By Glen Hallick, MarketsFarm

WINNIPEG, Nov. 9 (MarketsFarm) – Intercontinental Exchange (ICE) Futures canola contracts were lower on Monday, most likely due to profit-taking according to a Winnipeg-based trader.

He pointed out that Chicago soyoil and soymeal had been higher earlier in today’s session, but have pulled back.

“It looks like some spec long liquidation is leaking into the markets,” the trader commented.

There’s also some positioning ahead of tomorrow’s supply and demand estimates from the United States Department of Agriculture (USDA), he said. The markets widely expect yields, production and ending stocks for soybeans and corn to be lower compared to the USDA’s October report.

Read Also

ICE Midday: Canola regains positive momentum

Glacier FarmMedia – Canola futures on the Intercontinental Exchange resumed their rallies on Monday morning after seeing negative movement on…

“That’s causing people to take chips off of the table and head to the sidelines to see what’s going to happen,” the trader said.

There’s also a bit of uncertainty in the markets as China has suggested it may want to renegotiate its Phase One trade deal with the U.S, he added.

Despite a rise in the Canadian dollar the trader said it wasn’t influencing canola that much. The loonie was at 77.10 U.S. cents, compared to Friday’s close of 76.69.

Approximately 8,200 canola contracts were traded as of 10:47 CST.

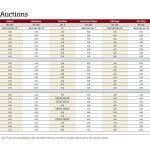

Prices in Canadian dollars per metric tonne at 10:47 CST:

Price Change

Canola Jan 543.00 dn 2.90

Mar 547.40 dn 2.80

May 547.70 dn 3.20

Jul 546.50 dn 3.00