By Phil Franz-Warkentin, MarketsFarm

WINNIPEG, Nov. 17 (MarketsFarm) – The ICE Futures canola market was stronger at midday Tuesday, hitting fresh contract highs as solid end user demand and bullish technical signals provided support.

Chicago Board of Trade soybeans were trading at their strongest levels in more than four years at midday, providing additional spillover support for canola.

“Both canola and soybeans have to deal with the fact that supplies will perhaps run out,” said a market analyst on the strength in the two oilseeds.

A weaker tone in the Canadian dollar also provided some support for canola.

However, CBOT soyoil retreated from early gains to trade near unchanged, putting some pressure on values. Scale-up hedge selling also tempered the upside in canola.

About 15,500 canola contracts traded as of 10:51 CST.

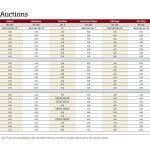

Prices in Canadian dollars per metric tonne at 10:51 CST:

Price Change

Canola Jan 563.70 up 4.40

Mar 566.70 up 4.20

May 566.00 up 3.70

Jul 563.90 up 3.40