By Glen Hallick

Glacier Farm Media | MarketsFarm – Intercontinental Exchange canola futures were higher on Friday morning, despite getting mixed spillover from outside markets.

While the Chicago soy complex and Malaysian palm oil were lower, European rapeseed was mostly higher. Crude oil was tacking on small increases, underpinning the vegetable oils.

The November canola contract edged below its 20- and 50-day moving averages, which were almost $1.50 apart.

The Prairie weather forecast called for rain over southern and central Alberta during the weekend, with the rest of the region to remain largely dry.

Read Also

North American grain/oilseed review: Canola continues lower

Glacier FarmMedia — The ICE Futures canola market continued to trend lower on Tuesday, hitting its lowest levels since March…

The Canadian Grain Commission reported canola exports for the week ended July 20 improved to 202,400 tonnes. With two weeks left in the 2024/25 marketing year that brought total exports to nearly 9.44 million tonnes. On Monday, Agriculture and Agri-Food Canada projected canola exports for 2024/25 at 9.50 million tonnes.

The Canadian dollar turned weaker on Friday morning, with the loonie falling to 73.07 U.S. cents compared to Thursday’s close of 73.37.

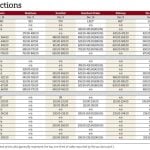

Approximately 8,300 contracts were traded by 8:35 CDT and prices in Canadian dollars per metric tonne were:

Price Change Canola Nov 698.70 up 3.00 Jan 708.10 up 3.00 Mar 714.90 up 3.30 May 720.00 up 4.10

To access the latest futures prices, go to https://www.producer.com/markets-futures-prices/