CNS Canada — ICE Futures Canada canola contracts moved steadily higher over the past week as grain markets reacted to a mounting trade dispute between China and the U.S.

While no sanctions are yet in place, the back-and-forth sabre-rattling between the two countries now includes proposed Chinese tariffs on U.S. soybeans, which weighed heavily on the Chicago Board of Trade futures as China is a major buyer of U.S. beans.

“I suspect there is plenty of bluster, but the issue will eventually settle down,” said analyst Mike Jubinville of ProFarmer Canada.

Read Also

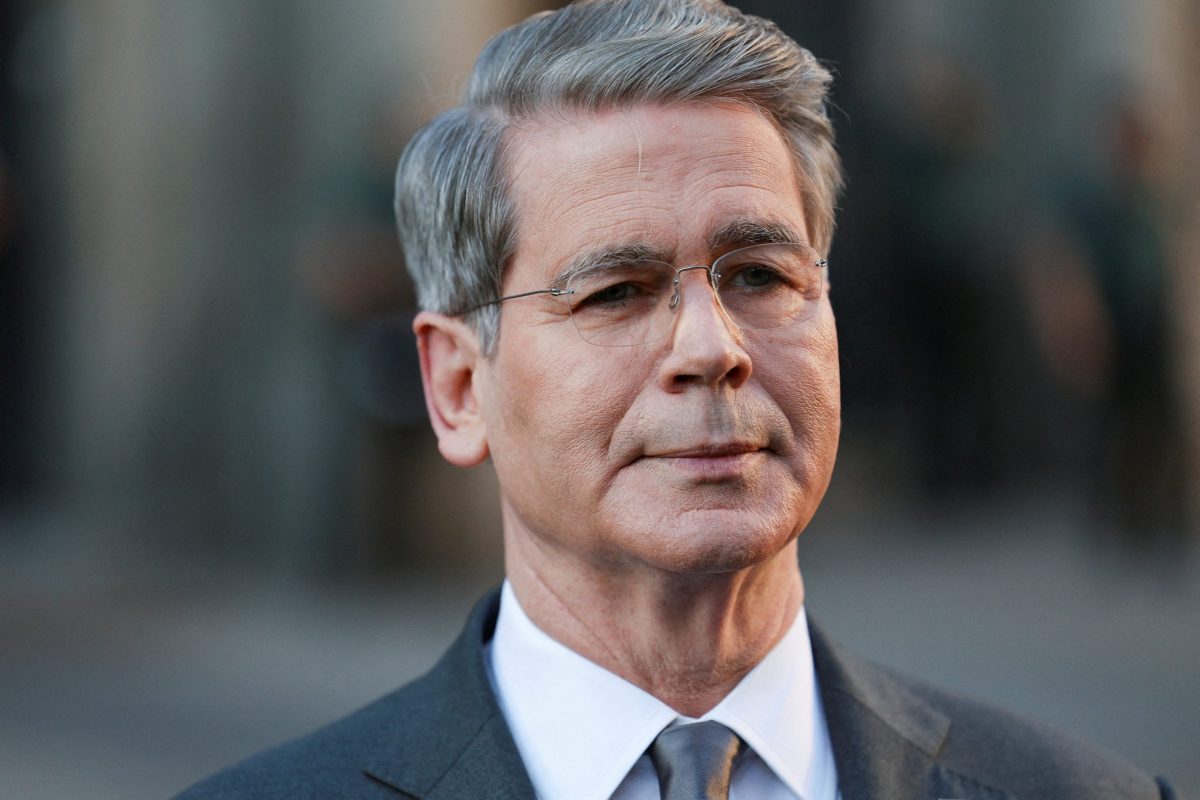

China to buy 12 million metric tons of soybeans this season, Bessent says

U.S. Treasury Secretary Scott Bessent said on Thursday that China has agreed to buy 12 million metric tons of American soybeans during the current season through January and has committed to buying 25 million tons annually for the next three years as part of a larger trade agreement with Beijing.

In the meantime, the prospect of tariffs on soybeans “could actually be an aid to canola,” hesaid, pointing to the possibility that China could end up buying more canola from Canada.

The Vancouver cash basis has moved from about $40 per tonne above the futures, loaded on the boat, to around $60 per tonne over the past day, according to Jubinville.

“I think China is doing some anticipatory buying as a precaution,” he said, noting that port prices for soybeans in Brazil were also seeing a jump.

“This is providing some underlying support for canola futures.”

In the bigger picture, if China buys fewer soybeans from the U.S., it will still buy them from somewhere else. If Brazil is then selling more beans to China, that means it has less to sell to Europe or elsewhere, which in turn opens the door for the U.S. to go other places.

“It’s not that we’ll trade less soybeans out of the U.S., it’s just trading the dance partners,” said Jubinville.

While the China/U.S. dispute may yet blow over and the volume of grain traded will remain the same, it will create increased volatility in the marketplace, he said.

While Canada could see more demand, the pipeline is limited and canola is still facing its own logistics issues.

“The garden hose to the West Coast is only so big.”

— Phil Franz-Warkentin writes for Commodity News Service Canada, a Glacier FarmMedia company specializing in grain and commodity market reporting.