Selling some farm owners on the wisdom of investing their hard-earned dollars in anything other than their own business can be difficult. They may want to put extra funds into buying more land or marketing quota to expand their operation. Or they may feel it’s best to direct funds towards various farm improvements or to pay down debt.

While there is a suitable time for all of these on-farm investments, investing everything back into the farm is not your best move for the long term.

Read Also

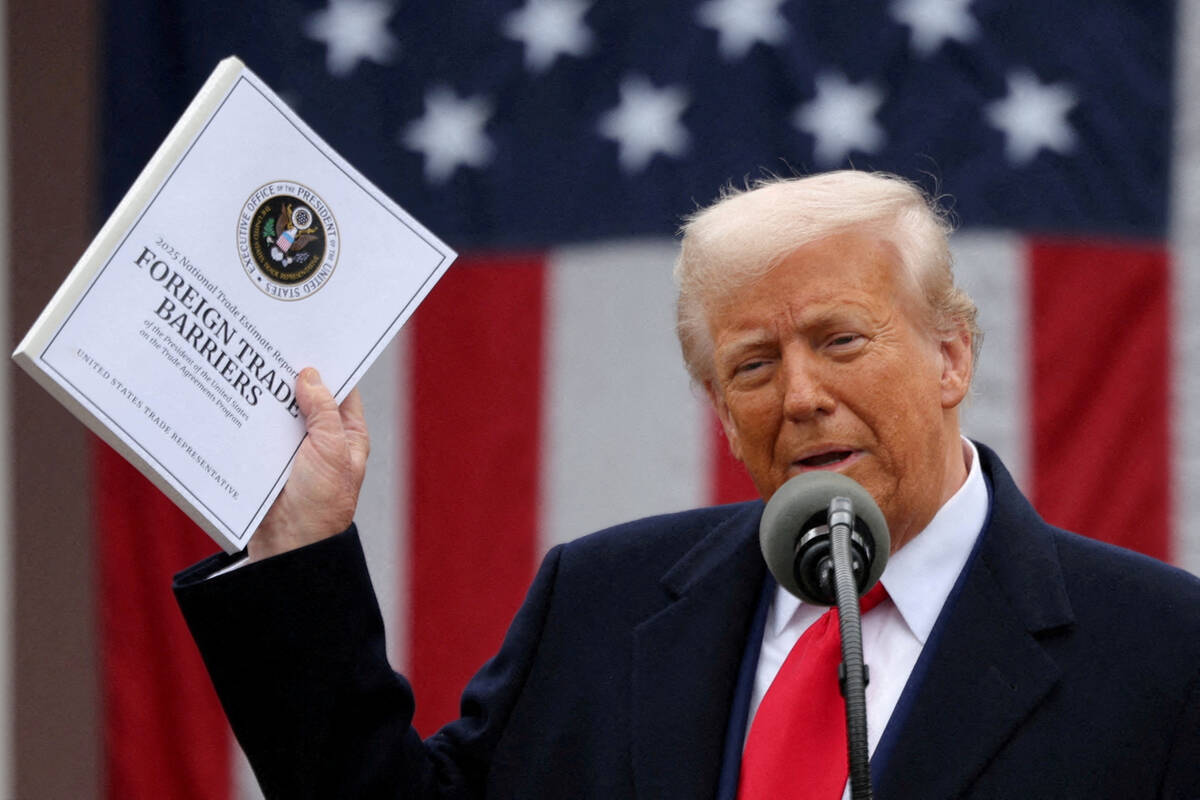

Producers aren’t panicking over tariffs and trade threats

The Manitoba Canola Growers Association (MCGA) surveyed its members this spring to get a sense of how trade uncertainty was…

Investing some funds off-farm is equally important in meeting several important long-term objectives. Some experts even go so far as to suggest that by the time farmers are ready to retire, at least 40 per cent of their equity should be invested in non-farm assets.

Goal 1: Risk management

First, off-farm investments can help you with your farm’s risk management. You know that you will have some good years on the farm and other years when business is not so good. Off-farm investments that will perform well in a different phase of the economic cycle than the farm can increase your security when farming returns are not so good, as well as reduce your taxes during the good business years.

For example, if you make contributions to a Registered Retirement Savings Plan (RRSP) during years when your farm income is high, you could withdraw some funds from the RRSP to help you through low-income years. Knowing that those funds are available if you should really need them can provide the peace of mind that allows you to make better business decisions regarding the farm.

Contributing to the RRSP during high-income years also will allow you to reduce the amount of tax you have to pay on that income. Yes, you also could increase some of your farm expenses or purchase farm equipment to help reduce your tax bill. While buying needed equipment could make sense, investing in unnecessary equipment just to reduce your tax bill is not a wise strategy for the long-term.

Creditor-proofing your business is another way in which off-farm investments can help you manage your business risks. There are certain types of investments, such as some issued by life insurance companies and trust arrangements, that will help protect personal and/or business assets from creditors should your farm business ever fail.

Goal 2: Retirement income

The second major objective of off-farm investments should be to help provide for sufficient retirement income. You may be planning to sell your farm and use the after-tax proceeds to fund your retirement income stream. However, if your retirement is several years down the road, it could be difficult to predict today exactly how much you will make on the sale of the farm and whether it will be sufficient to provide for your desired retirement lifestyle. Changes in global commodity markets, the Canadian economy, exchange rates, government legislation or weather could adversely affect your farm operation and undermine the value of your farm assets.

This plan could create additional challenges if you want the farm to stay in your family when you retire. Often family members cannot afford to pay you what the property is worth — and what you will need for a comfortable retirement — without incurring onerous debt.

If you have off-farm investments that can help fund your retirement, it will lift a great burden from both you and your family members. You would have the flexibility to reduce asset transfer prices or delay or forgive loan payments by your children while they build up their own farm and off-farm net worth. And you could have funds available to buy your retirement home so your family members could take over the farm residence.

Goal 3: Estate planning

A third objective of off-farm investments relates to estate planning. Should you die prematurely, off-farm investments, such as life insurance, can provide the cash necessary for your family to carry on the farm business. Off-farm investments also can play a role in dividing up your estate when you retire. They can be particularly helpful when it comes to making a fair division of your estate when you have one or more children who will take over the farm and others who will not be involved. It’s also very important to review your disability, critical illness and long-term care insurance coverage to protect your estate.

It’s clear that off-farm investments can help you achieve some important objectives. But to be effective, you will need a plan for ongoing, regular off-farm investing. You’ll likely want to seek the advice of an investment professional who can help you identify concrete, specific investment goals, your time horizon for these goals, and your tolerance for risk.

Financial and tax advisors can also help you learn about different investment opportunities and help you choose the right ones that integrate with your overall tax management plan to minimize annual and longer term tax burdens.

Different asset classes you might consider for both your registered and nonregistered investment portfolios include