By Marlo Glass, MarketsFarm

WINNIPEG, Jan. 10 (MarketsFarm) – Intercontinental Exchange (ICE) Futures canola contracts finished the week slightly stronger, due to neutral reports from the United States Department of Agriculture (USDA).

One trader said he was surprised markets didn’t “go sky-high” following the World Agriculture Supply Demand Estimates (WASDE). Taking its cue from Chicago soybeans, canola only posted modest gains.

Relative strength to the Canadian dollar put pressure on canola values. The dollar was at 76.6 cents at midday.

On Friday, 23,720 contracts were traded, which compares with Thursday when 26,735 contracts changed hands. Spreading accounted for 18,662 contracts traded.

Read Also

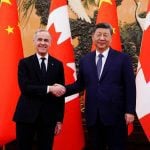

North American Grain/Oilseed Review: Canola up on new trade deal, positives for U.S. grains, oilseeds

Glacier FarmMedia — Canola futures on the Intercontinental Exchange were higher on Friday, hours after Canada and China announced a…

SOYBEAN futures at the Chicago Board of Trade (CBOT) were slightly stronger on Friday.

The WASDE raised U.S. soybean production by 8 million bushels, due to higher yields in key growing regions. Market participants had expected the agency to cut estimates due to challenging weather conditions throughout the growing season. However, the USDA says U.S. soybean ending supplies will total 475 million bushels, which was unchanged from the report in December.

Brazil is still expected to produce 123 million tonnes of soybeans, and Argentina around 53 million. Global ending stocks were pegged at 96.7 million tonnes, which is a slight upward adjustment from December’s estimate of 96.4 million tonnes.

Last week, soybean export sales totaled over 355,000 tonnes, which was an 8 per cent increase from the previous week but 59 per cent lower than prior 4-week average.

CORN futures finished slightly higher today.

The USDA supply demand report increased U.S. corn production numbers to total 13.692 billion bushels. In last month’s report, the projected total was 13.661 billion bushels.

U.S. corn ending stocks were reduced by 18 million bushels to total 1.89 billion bushels. Domestic demand for corn remains strong, mostly for livestock feed purposes, which tempered the bearish data.

Globally, corn ending stocks declined 2.74 million tonnes to total 297.8 million. That was generally in line with market expectations.

Last week, corn export sales totaled just under 162,000 tonnes, which was a low for the marketing year. That’s 70 per cent lower than the previous week and 83 per cent lower than the four-week average.

WHEAT futures were stronger on Friday.

Ending stocks for U.S. wheat are at 965 million bushels, which is a 9 million bushel decline from last month’s report.

Global ending stocks for wheat were also revised down by 1.42 million tonnes to total 288.1 million tonnes.

U.S. farmers planted 30.8 million acres of winter wheat this fall, which compares to 31.2 million acres that was planted last year.

Last week, wheat export sales totaled just over 80,000 tonnes, which was 74 per cent lower than the previous week and a low for the marketing year.

END